Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,369

- Reactions

- 11,730

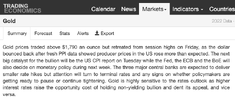

The BIS have now closed their short position in gold. The BIS are now actively accumulating gold as are the other CBs.

View attachment 150038

The end of paper price manipulation has pretty much arrived. There may be some attempts into January 2023, but pretty much it's over.

jog on

duc

JP Morgan might have opened some longs too.