Stockbailx

"Profit Compoundd" Rules

- Joined

- 10 May 2021

- Posts

- 632

- Reactions

- 508

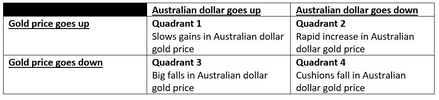

I'm bit confused! I've always been under the impression that when the AUD goes down, the POG goes up. Lately since late August the AUD price has been going down. The last few days the AUD has been suffering from lower highs, lower lows. The same could be said for the price of gold AU. You would think that the price of gold AU would be doing the opposite, higher lows higher highs. But not to be, just when I thought I had it mastered. What gives, what holding POG AU down?...

Last edited: