Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,976

- Reactions

- 11,017

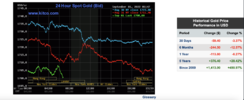

Well the last few wagons of the Gumnut Goldtrain are at last coming back close to profit.

Trying to second and third guess the POG with the USD and AUD can be quite a pain. I wouldn't want to be depending on it for a short term punt.

Much as I have nothing against Mrs Pelosi I was hoping she would do an Ivana Trump fall on the turps down the stairs at the American Embassy in Taiwan, without her having to end up 6 yards wide of the hole at the first green at Bedminster of course.

gg

Trying to second and third guess the POG with the USD and AUD can be quite a pain. I wouldn't want to be depending on it for a short term punt.

Much as I have nothing against Mrs Pelosi I was hoping she would do an Ivana Trump fall on the turps down the stairs at the American Embassy in Taiwan, without her having to end up 6 yards wide of the hole at the first green at Bedminster of course.

gg