- Joined

- 25 July 2021

- Posts

- 878

- Reactions

- 2,216

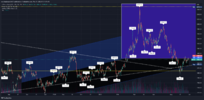

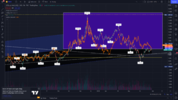

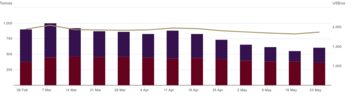

Hope this forecast works out, there are a lot of people waiting for the final low.If we get counter trend Top into the 30th May the three key price levels to watch are 1879 1882 and 1894 . After this point trend should continue down into the X June where main Low is indicated .