- Joined

- 25 July 2021

- Posts

- 877

- Reactions

- 2,215

You got your re-entry point!Looking at the GLD daily chart, it can be seen that gold has found some support at the 177-179 zone. You can see volume pick up over the last two days from buyers coming in at this level. The retracement down to this level corresponds to a 0.618 pullback. If we get follow-through to the upside tonight then this would be a good re-entry point, I'll see what happens tonight;

An ouchie recent few days for Gold.

London selling it down again.

It may fall further.

View attachment 139348

gg

My guess would be that Gold will drift back down to $USD1800 when with our appreciating AUD it will be quite tasty again.I think it’s the war premium coming off. Was at least $100 baked in. Hoping it holds above $1900-1850 to consolidate after the break up. Conditions making things pretty volatile atm. Hopefully it doesn’t get worse.

The 4 month trend is still positive and TSI is heading north again.My guess would be that Gold will drift back down to $USD1800 when with our appreciating AUD it will be quite tasty again.

POO and POI will go up, I suspect, and Gold won't be a goer gain until they stabilise at new highs for the last 12mo.

And to paraphrase those on The Spectrum who say on other forums, and it is creeping in here DDYOR, "Don't Do Your Own Research"

gg

Thanks @rederob .The 4 month trend is still positive and TSI is heading north again.

TSI seldom stays under "0" for long when the short term trend is positive:

View attachment 139353

Here's the 6 month trend on a 4 hourly chart:Thanks @rederob .

I don't use the TSI and had to look it up. So it's used similar to an RSI , is that correct, diverging from consolidating price ?

Can you throw a 6 mo chart of gold up with a TSI when you get a chance please.

DDYOR. in fact DEDYOR and EYG.

gg

GLD is still holding between the 50% time&price FIB and the 177-179 support zone, rejecting each when the price gets near. To me it looks to be in a holding pattern, I'm waiting for a break either way with a some volume coming in;

View attachment 139373

Sometimes in order to see a market more clearly I will step back a bit and take a fresh look at the bigger picture. If we look at a three day chart of GLD it's easy to see the market has come down and paused at the support zone;

View attachment 139374

Many years ago, a very wise trader named Mazda6 told me to be cautious of cups with handles, they often break off! I never forget good advice, or who gave it to me.Looks like a C&H could possibly be going to form on this chart on the long term C&H which is interesting.

Many years ago, a very wise trader named Mazda6 told me to be cautious of cups with handles, they often break off! I never forget good advice, or who gave it to me.

I would be a bit cautious this may fall a tad below a handle percentage with such a massive volume spike at the high point. I would expect far more downside before we see a rise, perhaps even below the 200dmas? I don't know but I am waiting for gold to retest the 200mas before entering. May just be me and I am often wrong.

View attachment 139391

I‘m extremely cautious about any TA. It’s only good till it fails which could be the majority of the time. It’s recognising failure and managing exits that’s probably more important. I’m **** at both.

(I‘m not sure why schit gets buffed out Joe. That’s not a swear word these days is it?)

Thanks duc.Gold and Silver are THE most manipulated markets in the world. TA is almost worthless as a way to really understand these markets.

So this is JPM moving from SLV to their vault 38M ounces in preparation for settlement of delivery:

View attachment 139428

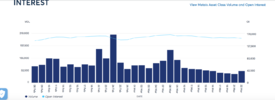

This is the OI at 158,000 contracts:

View attachment 139429

Each contract is 5000oz.

Now many will close, net out, roll forward. However, those that stand for delivery cannot exceed that 38M oz without (a) defaulting or (b) JPM shifting more physical.

The March contract in gold had all manner of shenanigans going on. There was a 'technical' default that JPM managed to hide with the aid of BAC.

JPM have been fined billions of dollars for 'painting the tape' and outright manipulations.

The game blows up when they can no longer meet the demand for physical, which is growing daily.

Very bullish gold/silver.

jog on

duc

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.