- Joined

- 31 March 2015

- Posts

- 477

- Reactions

- 865

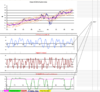

I am a gold bug, but I have to trade what I see and at the moment I don't like the price action that is unfolding here. There is a so much bullish sentiment around at the traps at the moment which also makes me wary. Short term the following 8hr closes are bearish(at least for the next week) and as such I took out short positions today as this is also accompanied what appears to be a completed 5 wave structure from the March 17 low and a daily engulfing red candle.

Longer term I think we are in the process of forming a top here that will stall the market until early next year as shown in the delta chart attached but this needs to be confirmed in the dynamic cycles chart which it has not done yet. Assuming it is however, next cycle point low red 8 is next year.

Longer term I think we are in the process of forming a top here that will stall the market until early next year as shown in the delta chart attached but this needs to be confirmed in the dynamic cycles chart which it has not done yet. Assuming it is however, next cycle point low red 8 is next year.

Last edited: