- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

Gordon, at what point and price would entice you to buy, bearing in mind that possibly once it is apparent to the general population that the cb's don't actually have a clue, that some sizeable gains in gold won't already have taken place? Interesting to hear your thoughts.

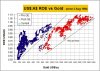

As to gold equities, there has been a very trade-able bounce off oversold lows and is the best sector so far this year. And yes, their prices do not reflect the higher margin that is being attained from the price in AU terms and cost efficiencies (and the oil price).

Although could be some profit taking on the $40 hair cut today - a buy opportunity?

As to gold equities, there has been a very trade-able bounce off oversold lows and is the best sector so far this year. And yes, their prices do not reflect the higher margin that is being attained from the price in AU terms and cost efficiencies (and the oil price).

Although could be some profit taking on the $40 hair cut today - a buy opportunity?