- Joined

- 24 December 2005

- Posts

- 2,601

- Reactions

- 2,065

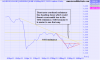

1400 is the line in the sand today for me, on the high side at least....if we did get thru that then a test of 1425 is likely....

1363, 1357 and 1350 are key levels downside for me...

CanOz

Ahh yes CanOz you are speaking for the day trade. I was thinking of the next couple of days. The daily POG looks as though it may develop an inverted flag or pennant.

Looking at the 1 minute chart just then, there was a nice pennant on a flagpole setup. Then whammo, got ya! Down she went. Dang this daytrading is exciting