explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,198

Higher low explod???

All I can see on the daily chart is a lower high.... hmmmm, buddy it's best you stop looking at your charts upside down.

As a kid on the farm, Dad would say as we lined up a fence post, "that's near as dammit" and it would be, a good straight bit of fence at the end of the day.

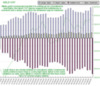

That gold chart is near as dammit to a good pennant from your top to the bottom of October, roughly (nrsdammmnt) and she has to break one way or the other soon. And did you get a load of that US$ index chart, if that's nrsdmmt then the gold break may be up.

you say Apo..dmit and cr.p

.