- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

It would be amusing except it means the worst of fears are materialising - watching the CB's 'transfer', via gold sales/leasing, their only form of real 'wealth value' to the early adopters of the realisation that global fiat money systems are close to failing?

The other important point is that generally gold equities are still in oversold territory. Think NCM, think $100 per share? Prepare for phase 3 - the manic scramble?

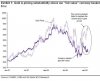

http://www.minyanville.com/articles/gold-spx-SP500-xau-gfi-mining/index/a/20881/p/1I believe gold’s clear break from its typical linkage to the dollar is revealing a recognition by the market that the fiat dollar-based monetary system that has been in place since 1980 has collapsed, and it has collapsed for the same reason that the US credit markets collapsed (i.e. - enormous imbalances resulting from too much money printing by the Fed). Thus, we’re now seeing a general investor fear of debasement of all fiat currencies globally (i.e. a fear of future inflation and the loss of purchasing power).

For example, the British (and others holding pounds) see the pound sterling collapsing much like Iceland saw its currency collapse, but they know the dollar has its own problems, as does the euro (although I would argue the euro has fewer problems than the dollar or pound at the moment, even though I know others might disagree).

Thus those who hold pounds exchange them for gold. The same goes for those who hold euros and those who hold dollars. This is what's increasingly happening on a global basis, and it’s this demand that's being reflected in the across the broad rally in gold in all these fiat currencies.

The other important point is that generally gold equities are still in oversold territory. Think NCM, think $100 per share? Prepare for phase 3 - the manic scramble?