- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

....and...you'll soon be able to buy gold directly from gold companies...at least one I have shares in will offer 1oz bars for sale.....

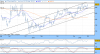

If the open interest is anything to go by I think the $1K peak reaction bear market for gold has finally worked it's way through the system? With stimulus packages yet to 'show us the money' doubt is growing over whether the CB maestros can pull a big rabbit out of their big, stretched hats, or will end up busking at the local railway station

If the open interest is anything to go by I think the $1K peak reaction bear market for gold has finally worked it's way through the system? With stimulus packages yet to 'show us the money' doubt is growing over whether the CB maestros can pull a big rabbit out of their big, stretched hats, or will end up busking at the local railway station