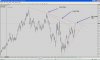

The daily chart hasn't even breached the last Lower Low yet and is yet to make a Higher High.

Needs to break $930 to get bullish.

Looking at your chart, the last pivot low was at around $800, so we are no where close to it... but we have made a higher high by passing $885. So starting from $670, we clearly have an uptrend of higher lows and higher highs.. a good consolidation / pullback under $930 should see more upside