IFocus

You are arguing with a Galah

- Joined

- 8 September 2006

- Posts

- 7,694

- Reactions

- 4,805

Good to be pickled and the crapola is tangible. And human too, lost yer patience mon ami.

Anyway, my rough take

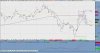

Weekly gold chart forming a large pennant, top is March 08 at US$1,000 and bottom Aug 06 at $640. Will have to break out within 20 weeks from here which is just about the time the new US admin takes the helm and causes one hell of a problem, or at lest the blame for it.

Dont' see much PPT or conspiracy in the possibilities here.

Explode I don't understand the FA drivers of the gold price but have long read gold bugs talk about its ascendancy given the right conditions which correct me if I am wrong appear to be now.

Main St is fairly aware some thing is amiss, the market knows that the bail out really isn't going to change anything and the risks are frigging massive world wide, this information will arrive at main st any week / month now.

But gold is not at $2000 plus its plugging $800 odd.

I know its had a nice run up from $250 ish and the current up side to me looks stronger when viewing the chart but that is still to be confirmed and not a given.

Do you or Refined Sliver / Uncle have a view as to its current position and why, not looking for an argument just wondering why.

One thought I had is the wealth around the place is tied up in credit and cannot be transferred to gold easily, but the total gold market is very small in world terms..........