- Joined

- 23 October 2005

- Posts

- 859

- Reactions

- 0

This post is for TA people only

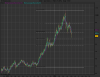

The following is a chart of the PHLX Gold and Silver Sector in the US.

It gels very nicely to the analsysis made on spot Gold some weeks ago before the current leg down began:

https://www.aussiestockforums.com/forums/showpost.php?p=284834&postcount=4035

This is a texbook completed impulse, they don't much better than this. Statistically speaking wave 2's or the abc correction usually retraces 38.2-50% of the whole advance. Many times however it is 61.8%. A good guide line is the span of the previous wave 4. These are approximate levels only. But judging from these figures this sector has much further to go down. These charts show great confluence.

The following is a chart of the PHLX Gold and Silver Sector in the US.

It gels very nicely to the analsysis made on spot Gold some weeks ago before the current leg down began:

https://www.aussiestockforums.com/forums/showpost.php?p=284834&postcount=4035

This is a texbook completed impulse, they don't much better than this. Statistically speaking wave 2's or the abc correction usually retraces 38.2-50% of the whole advance. Many times however it is 61.8%. A good guide line is the span of the previous wave 4. These are approximate levels only. But judging from these figures this sector has much further to go down. These charts show great confluence.