- Joined

- 10 December 2012

- Posts

- 3,632

- Reactions

- 9

seems it'll be rinse and repeat in the USA shortly

http://davidstockmanscontracorner.c...-feds-zirp-is-fueling-the-next-subprime-bust/

This $120 billion subprime auto paper machine is now driving millions of transactions which are recorded as auto “sales”, but, in fact, are more in the nature of short-term “loaners” destined for the repo man. So here’s the thing: In an honest free market none of these born again pawnshops would even exist; nor would there be a market for out-of-this-world junk paper backed by 115% LTV/75-month/20% rate loans to consumers who cannot afford them.

http://davidstockmanscontracorner.c...-feds-zirp-is-fueling-the-next-subprime-bust/

This $120 billion subprime auto paper machine is now driving millions of transactions which are recorded as auto “sales”, but, in fact, are more in the nature of short-term “loaners” destined for the repo man. So here’s the thing: In an honest free market none of these born again pawnshops would even exist; nor would there be a market for out-of-this-world junk paper backed by 115% LTV/75-month/20% rate loans to consumers who cannot afford them.

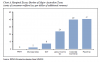

Indeed, from the low point in early 2010, the subprime market has increased by more than 100% or double the rate of growth in prime auto loans, which have also expanded at a heady pace (40%) relative to the tepid growth of consumer incomes (12%) during the period. Stated differently, the auto sector is being pushed back into an unsustainable boom based on the very same bubble finance distortions that sent the entire industry””led by GM, Chrysler, Delphi””into the calamitous bankruptcies of 2008-2009.

In short, there is a reason why capitalism requires honest price discovery in financial markets. Without it, false signals quickly flow through the real economy, causing booms and busts that are not an inherent result of the free market but the artificial and destructive consequence of central bank intervention and manipulation.

Half the issuers tracked by Standard & Poor’s hadn’t sold bonds before 2010, and concern is mounting that growth in the market for securities backed by car loans to people with poor credit poses a risk to the whole auto industry. Wall Street banks have arranged $20.6 billion of the deals this year, up from $8.6 billion in 2010, according to Barclays Plc.