- Joined

- 2 June 2011

- Posts

- 5,341

- Reactions

- 242

http://blogs.reuters.com/james-saft...ds-cash-individuals-holdings-hit-14-year-low/

Individual investors have been cutting back on cash in portfolios, the exact reverse of what Warren Buffett has been doing at Berkshire Hathaway.

Who do you think has got it right?

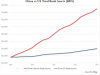

Cash at Berkshire Hathaway stood at just over $55 billion as of June 30, an all-time high and two and a half times

the level he’s in the past said he likes to keep on tap to meet extraordinary claims at his insurance businesses. That’s also up more than 50 percent from a year ago.

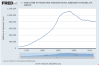

Buffett’s green pile is in sharp contrast to individual investors, who’ve cut cash in portfolios to 15.8 percent, a

14-year low, according to the July asset allocation survey from the American Association of Individual Investors.

I saw that. I think you need to read it in context. BH is huge these days, so their investment universe is pretty small. Couple that with the fact that BH doesn't pay dividends and there isn't many options but to hoard cash.

Buffett has said for decades that the average investor should be 100% invested all the time. And as for his own estate...

My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s. (VFINX)) I believe the trust’s long-term results from this policy will be superior to those attained by most investors ”” whether pension funds, institutions, or individuals ”” who employ high-fee managers.