- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

Taking a small loss. It should have taken off just then.

-5.

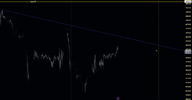

On review, this was a ledge or bear flag (pink). Seen on 20m TF. My rule is: The bigger the fall leading to the pause in downwards momentum, the bigger the volatility swings need to be in order for a reversal to happen.

The first swing up was ok (first yellow line), but it was followed by a very flat swing up (2nd yellow line). The big run up from the previous day was the give away. There was reasonable buying during the ledge but I've seen that before - that's the bull trap - luckily I saw it in time.

No instrument will do this following a big run up. Not very often anyway.