- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

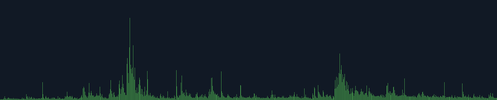

Maybe I was just a day early with that observation. Need to keep this in mind for next time. Markets are certainly dumping now.Obviously got that wrong. The pattern over several hours was something I hadn't seen before, and I thought I'd take a guess.

It was sideways movement with consistent selling, interspersed with 20 or so strong buying candles (more than usual - 6 is a lot). But no medium strength buying. Sort of like sell, sell, sell, sell, sell, sell, BUY, sell, sell, sell, sell, BUY.