- Joined

- 28 August 2022

- Posts

- 6,520

- Reactions

- 10,528

WayneL Good evening

Probably similar to local sales, but always depends on the buyers on the day. Is anyone's guess week by week.

Station cattle vs Euro x types also.

WayneL Good evening

Might be good for Australian Rice growers, seeing as here is plenty of water around for rice productionIndia's decision to ban non-basmati white rice exports will spur traders to cancel contracts to sell around 2 million metric tons of the grain, worth $1.4 billion, on the world market, dealers have said.

Key points:

- On Thursday, the government said the ban would be effective from July 20

- Four dealers confirmed that export contracts worth $1.4 billion could be cancelled

- India used to sell around 500,000 tons of non-basmati white rice every month

India, which accounts for 40 per cent of world rice exports, on Thursday ordered a halt to its largest rice export category to calm domestic prices, which climbed to multi-year highs in recent weeks as erratic weather threatens production.

Anticipating that the government would impose restrictions on rice exports, traders have obtained letters of credit (LCs), or payment guarantees, over the past few days, said a Mumbai-based dealer with a global trade house.

"But the trade wasn't expecting the government to impose restrictions so soon. It was expecting them to come into effect in August or September," he said.

"As a result, these traders have no choice but to use the force majeure clause to cancel the contract."

Force majeure refers to unexpected external circumstances that prevent a party to a contract from meeting their obligations.

Four dealers confirmed that export contracts of around 2 million metric tons of rice, worth $1.4 billion, are at the risk of being cancelled.

On Thursday, the government said the ban would be effective from July 20, and only vessels currently loading would be allowed to export, not future shipments backed by LCs.

"Traders typically sign contracts in advance, so the contracts signed for the next few months cannot be executed now," Nitin Gupta, senior vice president of Olam Agri India Ltd told Reuters

Rice as well as wheat has increased in price, which in turn has increased the price of Pork.For the second time in he ast fve years, India has restricted the sale of rice exports to keep the local prices down

From ABC News

Might be good for Australian Rice growers, seeing as here is plenty of water around for rice production

Mick

Singapore is the world leader in selling cultivated meat

America is about to challenge the Asian’s country’s early start

The island-state’s long history as a maritime trading hub, bringing together Chinese, European, Indian and Malay migrants, has given Singapore a rich culinary culture. It got even more diverse in December 2020 when the country became the first to grant regulatory approval for the commercial sale of meat produced in a lab from cultivated animal cells.

Concerns about food security underlie Singapore’s push into alternative proteins. A country half the size of London, which makes only 1% of its land available for food production, Singapore imports over 90% of its food. To protect itself from a volatile food supply chain, disruption by unpredictable neighbours, inflation, pandemics and war, the government aims to produce 30% of the country’s food by 2030.

It is encouraging experimentation with cultivated animal cells, meat, dairy and eggs made from plants, and food made from microbial or gas fermentation. Annual private funding for Singapore-based alternative-protein companies doubled to $170m in 2022, according to the Good Food Institute apac, an ngo that promotes alternatives to animal products.

A common challenge for alternative-protein startups is that they need to spend a lot of their initial investment on new equipment. This means they can struggle to become profitable without heavy capital outlays. The government has therefore invested in relevant infrastructure such as innovation centres that help startups develop their products and raise capital. Nurasa, an alternative protein service provider backed by Temasek, a Singaporean sovereign wealth fund, helps startups minimise the risk of buying expensive equipment by renting out labs and kitchens that replicate a restaurant environment. This allows firms to test their product and business model before purchasing their own equipment, says Jolene Lum, its head of business development.

Singapore has also become the global launch-pad for foods made through precision fermentation, notes Mirte Gosker of the Good Food Institute apac. Solar Foods is a Finnish startup that uses gas fermentation to feed microbes with hydrogen and carbon dioxide. It turns the resultant liquid into a powder, known as Solein, which is nutritionally similar to dried meat. In June the firm launched the world’s first Solein chocolate gelato in Singapore.

Very Dairy, an animal-free milk brand of a firm based in California, first launched in Singapore in 2022. The milk is biologically identical to conventional milk proteins but made from microbes instead of cows. That may be good for the climate, since farmed cattle produce a lot of methane, a powerful greenhouse gas. Greenhouse-gas emissions from animal-based foods are estimated to account for around a fifth of man-made climate change.

Singapore has encouraged the industry by offering a clear regulatory framework and an efficient approval process. Solar Foods has been waiting for two years for regulatory approval in the European Union, says the company’s ceo, Pasi Vainikka. The eu has yet to approve any cultivated meat products for sale. By contrast, Solein was granted approval in Singapore within a year. This fast and transparent process means that many products appear in Singapore first, which is “a huge gift for the whole world because Singapore shows what is possible”, says Mr Vainikka.

Whether those products can be taken to scale remains unclear. Even in Singapore the alternative-proteins industry faces high production costs and other burdens. The only cultivated-meat company to have received approval in Singapore is Good Meat, an American firm. It sells less than 2,300kg a year of its cultivated chicken. For context, global meat production is forecast to grow to over 360m tonnes this year.

Last month America became the second country to approve the production and sale of cultivated meat. Two companies, Good Meat and Upside Food, have already got the go-ahead to sell cell-cultivated chicken there. America’s vast consumer market and cutting-edge technology could be about to threaten Singapore’s early lead.

Ah a vegan's delight not a morsal of meat to be seen."Concerns about food security underlie Singapore’s push into alternative proteins."

Singapore are getting serious with producing 'alternative' foods. We could be seeing a new era of food production to match the rise of the mega farms, cheap fertilizers and genetics.

"It is encouraging experimentation with cultivated animal cells, meat, dairy and eggs made from plants, and food made from microbial or gas fermentation."

Ah a vegan's delight not a morsal of meat to be seen.

Fortunately for this rooster, meat a plenty, red, white and fish, also eggs. All the real deal thankyou.

... this story is gaining traction... Pakistani floods in Punjab didn't help...For the second time in the last fve years, India has restricted the sale of rice exports to keep the local prices down

When it comes to food supplies, je suis Mormon.Yup, I can see the day that even my/our stockpiles will look meagre and dire. While we haven't gone over board and certainly not in the doomsday prepper league, we have upped the ante on storing supplies.

You have manyWhen it comes to food supplies, je suis Mormon.

My Mrs would scold you for giving me ideasYou have manyconcubines, um, stores/supplies/pantries?

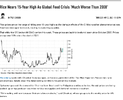

The shortage of rice has caused its price to reach a approach a 15 year high.For the second time in he ast fve years, India has restricted the sale of rice exports to keep the local prices down

From ABC News

Might be good for Australian Rice growers, seeing as here is plenty of water around for rice production

Mick

The general consensus is that people can survive for around three days without water, with estimates typically ranging from two days to a week. Wilderness guides often refer to the “rule of 3”, which says that a person can live for 3 minutes without air (oxygen), 3 days without water, and 3 weeks without foodYou have manyconcubines, um, stores/supplies/pantries?

hmmm , not being reflected in my GNC and SGLLV share pricesThe shortage of rice has caused its price to reach a approach a 15 year high.

View attachment 166567

Mick

There may not be much Australian rice in future for them to get a hand on it. Looks like the submission by Sunrice that the additional buybacks would make it uneconomic to grow rice in most years has been totally ignored. Looks like 500,000 tonnes less to feed the starving masses.The articles above refer to Thai rice and Indian rice.'

Australian Rice does not seem to get the same premium as Asian grown rice.

But I suspect if there is a shortage, they will be keen to get their hands on it.

Mick

Correct, it highlights the stupidity of people making decisions in Canberra who have little interest in or understanding of farming practices.There may not be much Australian rice in future for them to get a hand on it. Looks like the submission by Sunrice that the additional buybacks would make it uneconomic to grow rice in most years has been totally ignored. Looks like 500,000 tonnes less to feed the starving masses.

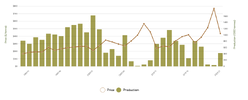

Rice has generally been grown only in those years when water sales are abundant and hence cheap.Australian rice growers produce more rice per hectare, than anywhere else in the world. The Australian industry averages over 10 tonnes per hectare. This is more than twice the global average of 4.3 tonnes per hectare.

Australia’s temperate climate in the Riverina makes it ideal for the production of high quality, medium grain rice, (high solar radiation, no pests and disease).

Australian rice is the cleanest and greenest in the world. Our growers use a unique crop rotation system, which takes advantage of natural biological controls, to help our growing areas remain free of serious pests and diseases. Australia's Rice Industry has lower chemical use than other countries in the developed world.

In 2020, temporary water was changing hands for 900 megalitre.The Australian almond industry has recently surpassed the Spanish almond industry as the second largest producer of almonds globally. Since 2006, almond production in Australia has increased from 23,000 tonnes in shell to 115,000 tonnes in shell. By 2025, Australian almond production is projected to be more than 185,000 tonnes in shell. Expanding the Australian almond industry is essential to reaching production forecasts and capitalising on the demand for almonds.

I don't eat rice!There may not be much Australian rice in future for them to get a hand on it. Looks like the submission by Sunrice that the additional buybacks would make it uneconomic to grow rice in most years has been totally ignored. Looks like 500,000 tonnes less to feed the starving masses.

Good, I don't sail yachts!.I don't eat rice!

Best you then make a Life on Betting on RiceGood, I don't sail yachts!.

mick

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.