- Joined

- 1 May 2007

- Posts

- 2,904

- Reactions

- 52

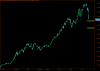

Can anyone post of chart of this company, would love to have a look at it from purely a T/A point of view.

Kind of scary because this would be the kind of stock I'd like to buy. Easy support and resist levels, shallow pullbacks indicating buyer str.

A stop @ 6.59 would have gotten some pretty awful fills