- Joined

- 1 October 2008

- Posts

- 3,733

- Reactions

- 395

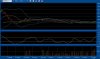

What 6 year crashing are you talking about?

The original point being that people who have been betting against the Chinese market for the last 6 years have got it totally right whilst the rest of the worlds markets had stunning rallies.

I've showed it till June because at that point I felt and was saying in this forum it was no longer worth shorting as continuing to bet with a 6 year downtrend is pushing your luck. About 2 months ago I called it a buy as it broke through 2500. All I did was trash it till then.

The recent drop in fuel prices is also very helpful for this basket case.

The fuel usage is indicating they are not growing.