tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,420

- Reactions

- 6,367

I knew that!

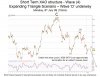

(5) Except that under EW there is a definitive set of corrective patterns and impulse patterns, which provides a useful guide to isolate the most likely pattern unfolding

(5) Except that under EW there is a definitive set of corrective patterns and impulse patterns, which provides a useful guide to isolate the most likely pattern unfolding