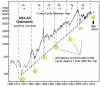

Short term market is moving as expected-an Impulsive advance developed from a bottom. After the correction the next leg should carry prices higher towards a descending bearish line, where the bearish count would be either approved if prices find support here, o denied if prices break higher.

Basicaly the entire 6 year advance from 2009 bottom will find a resolution at those levels, as the the next few weeks should determine the trend of the next few years, so the wave structure is very important here. I do not see a sideways movement that would last months, it's either sharp up or sharp down, in extreme manner.

Basicaly the entire 6 year advance from 2009 bottom will find a resolution at those levels, as the the next few weeks should determine the trend of the next few years, so the wave structure is very important here. I do not see a sideways movement that would last months, it's either sharp up or sharp down, in extreme manner.