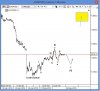

We are bearish at least until mid June and more likely into the months following that.

I know, it is popular to be bearish nowadays, because it is very hard to build a bullish case using todays fundamentals and economy, which are crap, to say at least.

But the question is whether you want to be outside the market progression, which is always Up? Bears usually miss bull markets, which is the only time money can be made. And if you do not see a major crash (more than 50% down), there is no point to stay away form the bullish trend, which I believe is in the early stages of development long term.