There was a good study made last year about global debt problems. According to a February 2014 study by the McKinsey Global Institute, “Debt and (Not Much) Deleveraging,” total global debt is up 40% since 2007 to $199 trillion. As a percentage of GDP, “debt is now higher in most nations than it was before the crisis” of 2008/2009. On average globally, it is 286% now vs. 269% in 2007. I am sure those figures are much higher by now.

Despite the economic rebound since 2009, McKinsey found that the debt of households, corporations and especially governments continues to rise. “Governments in advanced economies have borrowed heavily to fund bailouts in the crisis and offset demand in the recession.”

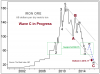

McKinsey warns of potential risks created by the latest surge in debt. But the danger is far larger and more imminent than the report suggests, as evidenced by Exhibit 12 in the study, which is reproduced below. The table shows GDP growth projections as well as “additional growth needed to start deleveraging.” The graphic shows 13 countries’ projected growth rates and how much more they must grow to reach the point where their debt burdens are sustainable, that is, to reverse the debt balloon.

Unfortunately Australia is not included here.

Over the next five years, these countries would have to maintain an average growth rate of 3.3% just to be able to retire some debt. Of course, the very idea that anyone would reduce debt in a growing economy is a pipe dream.

Behavior during the latest recovery proves that today’s mindset is driving people toward maximum indebtedness given any excuse.

The only thing that will stop them is outright depression and a turn toward that is not far away. Despite historic central bank stimulus, many global economies are on the path to outright contraction, signaling a heightened danger to the global economy.

In April, “business activity weakened in China and Japan and slowed in Europe and the U.S., suggesting the global economy may be less robust than policymakers are predicting.” The official IMF forecast calls for global GDP growth to exceed 3%, but the IMF’s chief economist concedes, “the world’s potential growth rate could be shrinking.” The U.S. is supposed to be the “growth star,” but a series of weaker-than-expected economic reports appeared in April.

“The U.S. Economy hasn’t Disappointed Analysts This Much Since the Great Recession,” says a Bloomberg headline.

U.S. businesses are pulling in their horns.

In March, orders for business equipment fell for a seventh straight month and first quarter corporate fixed investment fell at a 2.5% annualized rate, the most since the end of 2009. Growth prospects are far weaker than economists will admit, and that reality is causing credit conditions to deteriorate markedly around the world.

There is more to say, but the bottom line is that all of this is happening in the light of rising stock market. In bull markets, rising stocks tend to drag economies behind them, and the further they rise, the stronger the fundamentals become.

Looks more like bear market rallies which tend to go on their own, leaving the economies on their own. Funny times.

Despite the economic rebound since 2009, McKinsey found that the debt of households, corporations and especially governments continues to rise. “Governments in advanced economies have borrowed heavily to fund bailouts in the crisis and offset demand in the recession.”

McKinsey warns of potential risks created by the latest surge in debt. But the danger is far larger and more imminent than the report suggests, as evidenced by Exhibit 12 in the study, which is reproduced below. The table shows GDP growth projections as well as “additional growth needed to start deleveraging.” The graphic shows 13 countries’ projected growth rates and how much more they must grow to reach the point where their debt burdens are sustainable, that is, to reverse the debt balloon.

Unfortunately Australia is not included here.

Over the next five years, these countries would have to maintain an average growth rate of 3.3% just to be able to retire some debt. Of course, the very idea that anyone would reduce debt in a growing economy is a pipe dream.

Behavior during the latest recovery proves that today’s mindset is driving people toward maximum indebtedness given any excuse.

The only thing that will stop them is outright depression and a turn toward that is not far away. Despite historic central bank stimulus, many global economies are on the path to outright contraction, signaling a heightened danger to the global economy.

In April, “business activity weakened in China and Japan and slowed in Europe and the U.S., suggesting the global economy may be less robust than policymakers are predicting.” The official IMF forecast calls for global GDP growth to exceed 3%, but the IMF’s chief economist concedes, “the world’s potential growth rate could be shrinking.” The U.S. is supposed to be the “growth star,” but a series of weaker-than-expected economic reports appeared in April.

“The U.S. Economy hasn’t Disappointed Analysts This Much Since the Great Recession,” says a Bloomberg headline.

U.S. businesses are pulling in their horns.

In March, orders for business equipment fell for a seventh straight month and first quarter corporate fixed investment fell at a 2.5% annualized rate, the most since the end of 2009. Growth prospects are far weaker than economists will admit, and that reality is causing credit conditions to deteriorate markedly around the world.

There is more to say, but the bottom line is that all of this is happening in the light of rising stock market. In bull markets, rising stocks tend to drag economies behind them, and the further they rise, the stronger the fundamentals become.

Looks more like bear market rallies which tend to go on their own, leaving the economies on their own. Funny times.