- Joined

- 31 March 2015

- Posts

- 477

- Reactions

- 865

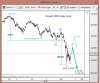

Well, if this happens, this means that market chose to go down through series of first and second waves, instead of a normal decline like I indicated in the previous post. Both possibilities are equal, but the result will be very much different. Series first and second waves usually indicates a bigger crash with an extended third wave. We will see this soon.

One who sits on cash have plenty of time and cold nerves to watch developments with clear mind. I personally see the upcoming events as a massive opportunity for those who have no debt, no shares and no any other commitments. For the rest it will be just pain.

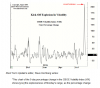

Well Rimtas today we reached 4800 the lower band of the cycles target. Prices at least in the short term have reached an extreme a sharp rally should start. May last into September and then the next down will start.

Negative news ever where supports this. When the media catches on we know are near a low for now anyway.