- Joined

- 28 May 2020

- Posts

- 7,050

- Reactions

- 13,718

In the Weekend Australian motoring Journalist Stephen Corby suggests that the Top EV models could be "thousands cheaper".

Europe can ease tax , stamp duty etc because the profits from them come back to the European countries.

We don't mass produce any cars, any more, indeed we don't even do the Knock down kits that were the bulk of oz cars back in the 70's.

AS usual, those with the most money want someone else to subsidise their EV.

All of these same foreign car manufacturers outsourced their building to cheap labour in Asian countries.

They have all said they will stop building ICE engines by 2030 or earlier.

Then Australian buyers will have no choice.

The manufacturers will be able to charge whatever they like, so why do they want subsidies now?

Mick

The problem is that all this approach merely subsidises the profits of overseas car makers.Electric vehicles in Australia could be not just cheaper, but tens of thousands of dollars less expensive if the federal government took the approach widely used in Europe by slashing luxury car tax, import duty, stamp duty and GST on EVs.

Those financial incentives would remove one of the biggest barriers to EV uptake – the high price of entry – and encourage car makers to bring more zero-emissions vehicles to Australia.

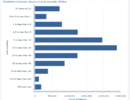

Modelling by The Australian shows EVs could cost between 10 and 25 per cent less by removing taxes and providing other incentives, pricing them more competitively with petrol alternatives.

Europe can ease tax , stamp duty etc because the profits from them come back to the European countries.

We don't mass produce any cars, any more, indeed we don't even do the Knock down kits that were the bulk of oz cars back in the 70's.

AS usual, those with the most money want someone else to subsidise their EV.

All of these same foreign car manufacturers outsourced their building to cheap labour in Asian countries.

They have all said they will stop building ICE engines by 2030 or earlier.

Then Australian buyers will have no choice.

The manufacturers will be able to charge whatever they like, so why do they want subsidies now?

Mick