- Joined

- 3 July 2009

- Posts

- 27,349

- Reactions

- 24,086

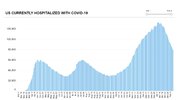

The thing is the virus has cranked up a notch, so maybe it wasn't just a flu, who knows."While pursuing its unusual strategy, Sweden questioned other nations’ decisions to lock down. Its path to mandatory restrictions has left the Nordic country with more than three times more virus deaths per capita than Denmark, the closest regional peer in terms of fatalities".

But it certainly seems to have put Sweden back to square one.