over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,291

- Reactions

- 7,507

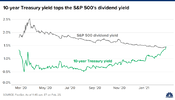

Currently wearing my smug face, I think I managed to call it to the day:So the risk premium for stocks has vanished, meaning we either get armageddon from here on out or we get a rebound.

Alright so the real story of this year is basically that the more things change, the more they stay the same.

Everyone are carrying on about now is both inflation and as an extension of that, stagflation. We've seen serious rises in the prices of almost everything lately - all foodstuffs, all electronics/tech, building supplies, you name it. A lot of this has been attributed to the massive quantitative easing program that the fed is undertaking but that is only a small part of the story. The real story is the fact that demand has remained stubbornly high for almost everything like this but supply has been choked off by coronavirus lockdowns. Ergo, we get demand either higher or at least steady, and supply choked off.

Jobs data everywhere has actually been far worse than expected, with the latest U.S data being about half what was anticipated:

View attachment 119834View attachment 119830

So question is, what's changed now vs a month or two or six ago?

Well, it's actually almost nothing. Lockdowns are still in place, money continues to be printed, and the supply of everything continues to be unable to keep up with the demand for it due to suppliers not being able to work or choke points at the ports.

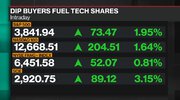

The result of this is that our previous barbell spread is actually even more pronounced now than it was previously. Everything's beating estimates, but it's the mega and especially microcaps that are smoking everything else:

View attachment 119833View attachment 119831View attachment 119832

The result is that a results matrix that long term looks like this:

View attachment 119829

Is now put on steroids:

View attachment 119837

In short, with interest rates controlling the balance between growth & value and interest rates at zero, growth massacres value until the P/E yields get somewhere near matching the capital cost (interest) rates.

Combine that with the fact that the tech companies are absolutely cleaning up and the previously tiny microcaps in areas like work/operate/live/etc from home get more demand every time we get lockdowns or stimulus (and we've had both) and industrials literally unable to operate even ignoring lockdowns because of the microchip shortage that is caused by everyone buying stuff precisely to keep them at home, and we end up with a full on feedback loop where more staying at home = more demand for chips = more industrials unable to operate = more people staying at home.

There's a lot of talking heads banging on about inflation & stagflation and saying that gold's due for another run, but I think they've missed the point entirely. Whilst it's true that the money printing is pumping everything, people seem to be forgetting that there's a massive supply-side restriction going on at the moment. The second people are able to get back in the workforce (due to being vaccinated, lockdowns being lifted, or both) supply can increase again.

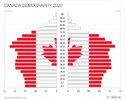

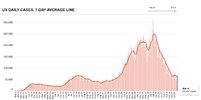

The good news is that it's all tailwinds & downhill from here. We've well & truly turned the corner of hospitalisations being over the hill of winter, so the warmer things get the less contagious the environment becomes:

View attachment 119838

And the vaccine deployments, whilst being slower than anticipated, are well & truly underway with an estimated 9 months until everyone's had their jabs in the U.S:

View attachment 119839

However, there's more vaccines in development/in the approval pipeline so we're very likely to see several more vaccines being deployed simultaneously. With that in mind, it's not unreasonable to expect that the job might be done sooner than anticipated, but murphy's law says not to actually expect that.

If that timeline's correct, the yanks will all be immune just in time for winter to shut everything down again, so I'm expecting organic (not stimulus driven) economic activity to keep increasing to a certain point maybe around end of Q3/start of Q4 this year, flatline through winter, and then REALLY take off in the winter melt/first half of 2022.

I guess the Whyalla steelworkers will be getting worried again, just when things looked like they were coming good.The spreading collapse of Greensill is not going to create confidence in the economic future of many companies particularly with the long term impact of COVID. Good analysis on the ABC. I suggest there may be some very naked swimmers out there.!!

To finance this, Greensill bundled these debts together — just as was done in the lead up to the GFC — sliced them up into portions and sold them off to investors.

The returns were attractive in a zero interest world, and to add an element of safety to the whole thing for investors, he insured the debt bundles.

Everything went swimmingly until last year. That's when the flaws became obvious.

Instead of vast numbers of suppliers, the clients were a smallish number of large corporations. There wasn't enough diversity to spread the risk, and when a few UK companies experienced difficulties in a COVID induced crisis, the insurers had to cover the losses.

The banks then realised some of these corporations were carrying far more debt than they'd disclosed, the insurers became twitchy about extending policies and the investors, sensing greater risk than they'd anticipated, began to back out.

That's when the whole scheme began to unravel. A fortnight ago, one of the biggest insurers for the scheme declined to renew policies over $US4.6 billion worth of investments and the investment banks directing clients to stump up the cash pulled the plug.

How one Aussie billionaire's fall from grace could wallop the city of Whyalla

Lex Greensill's rise from Bundaberg farmer to world-renowned billionaire wasn't your typical rags to riches story, but now he is desperately trying to stave off a collapse that threatens the livelihood of thousands, writes Ian Verrender.www.abc.net.au

I guess the Whyalla steelworkers will be getting worried again, just when things looked like they were coming good.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.