Good morning

An edge ... a good succinct explanation for newcomers is contained here:

www.investopedia.com

www.investopedia.com

Those new to trading/investing shouldn't be too concerned straight up about what their edge is.... at some stage very soon in the game someone upstairs will hit you over the head with a lump of 4 b 2 and then all of a sudden, the penny will drop ha ha ha ha ha ha

resilience extraordinaire ... ha ha ha ; and; one gets to realise why some make good profits whilst others do not. For mine therein lies the key to establishing your neech / edge.

Interesting stuff really.

For mine, 100% true that, certainly an essential in a traders/investors tool kit. Top shelf stuff. How to get there is the challenge that awaits us all.

Have a very nice day, today.

Kind regards

rcw1

An edge ... a good succinct explanation for newcomers is contained here:

The Importance of Defining Your Trading Edge: Find Your Strategy

A trading edge defines your technical or strategic advantage in the highly competitive market environment.

Those new to trading/investing shouldn't be too concerned straight up about what their edge is.... at some stage very soon in the game someone upstairs will hit you over the head with a lump of 4 b 2 and then all of a sudden, the penny will drop ha ha ha ha ha ha

resilience extraordinaire ... ha ha ha ; and; one gets to realise why some make good profits whilst others do not. For mine therein lies the key to establishing your neech / edge.

Interesting stuff really.

...

What is a Trading Edge?

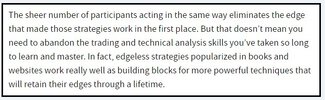

A trading edge is a distinct advantage that a trader possesses in the market that increases the likelihood of successful trading. It might be founded on a trader's knowledge, skills, expertise, or access to information that enables them to spot profitable market opportunities. Having a trading edge is critical for trading success, and traders must constantly develop and optimise their trading strategy to keep their edge (an advantage) in the market.

...

Finally, having a consistent edge is critical for trading success. However, an edge could be a fleeting advantage that requires constant modification and adaptation to remain effective. As a result, traders must constantly develop and "optimise" their trading strategy in order to stay ahead of the market and preserve their edge.

Skate.

For mine, 100% true that, certainly an essential in a traders/investors tool kit. Top shelf stuff. How to get there is the challenge that awaits us all.

Have a very nice day, today.

Kind regards

rcw1