- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

What I'm about to say regarding 'fear' and 'overconfidence' is not something that I've learnt from a book or a website, it's from my own experience and the way that I have come to view these things. Whenever I start to feel either of these it alerts me that I'm in a trading situation that I'm not fully prepared to handle, I take steps to get through this trade and note to follow up after the trade to find out what the missing information was that caused my fear or overconfidence.One of the most common feelings that traders experience is fear which can take many shapes, ranging from the anxiety of losing money to the worry of missing out on a few dollars of profits. During times of market volatility or uncertainty, these emotions can be extremely potent, making it harder for traders to make rational decisions.

Another common psychological obstacle that traders confront is overconfidence. Overconfident traders may take on excessive risk or make hasty decisions based on hunches, limited incomplete data, or incorrect information. This can result in huge losses and make recovery from setbacks or failures difficult for new traders.

What I'm about to say regarding 'fear' and 'overconfidence' is not something that I've learnt from a book or a website, it's from my own experience and the way that I have come to view these things. Whenever I start to feel either of these it alerts me that I'm in a trading situation that I'm not fully prepared to handle, I take steps to get through this trade and note to follow up after the trade to find out what the missing information was that caused my fear or overconfidence.

Basically I'm saying that if you have too much fear or overconfidence then it's because you have gaps in your knowledge.

Just the way that I see it, hope it's helpful for some people.

_SECTION_BEGIN( "VWAP" );

// The lookback period

lookback_period = Param( "LookBack", 11, 1, 300, 1 );

// Calculate the sum of the price multiplied by the volume over a lookback period

sum_price_volume = Sum( C * V, lookback_period );

// Calculate the sum of the volume over a lookback period

sum_volume = Sum( V, lookback_period );

// Calculate the volume-weighted average price (VWAP) using the sum of the price-volume and the sum of the volume

VWAP = sum_price_volume / sum_volume;

// Define the condition for buying based on the VWAP and the current and previous close prices

BuyCondition = C > VWAP AND C > Ref( VWAP, -1 );

// Output the BuyCondition value for debugging purposes

// This line can be removed in the final version of the code

printf( "BuyCondition: %g\n", BuyCondition );

_SECTION_END();

Some people that make the decision to learn trading either don't have $50,000-$60,000 or are not prepared to risk this much of their hard earned and saved capital, and prefer to allocate a smaller proportion of their funds to trading while they increase their skill and confidence to a level where they would be prepared to invest more of their money. If such people really want to learn mechanical system trading, the type of trading that @Skate uses then this can be done for a fifth to a tenth of the capital indicated by Skate if you are prepared to learn how to do it with Options.one of the most common questions that new traders have is how much money they need to start. While it is conceivable, to begin with a small amount of money, keep in mind that anything less than $50,000 or $60,000 can soon be eaten up by commission and other expenses which can reduce profitability.

Some people that make the decision to learn trading either don't have $50,000-$60,000 or are not prepared to risk this much of their hard earned and saved capital, and prefer to allocate a smaller proportion of their funds to trading while they increase their skill and confidence to a level where they would be prepared to invest more of their money. If such people really want to learn mechanical system trading, the type of trading that @Skate uses then this can be done for a fifth to a tenth of the capital indicated by Skate if you are prepared to learn how to do it with Options.

I know that not new traders have the amount of capital indicated by Skate, that may be one of the reasons why they want to learn trading in the first place, so I just wanted to let those people know that there is a way.

You never know Skate a bird in the hand..............................................My next-door neighbour came over for a cup of coffee this morning and she noticed I was posting a few comments in the "Dump it here" thread about trading.

After explaining my simple trading methods, and showing her a few backtests results, out of the blue, she said to me, "I could marry you".

I couldn't believe it, you do something nice for someone and they threaten to ruin your life in return.

Skate.

Only 5 trading days until the end of the financial year

Trading in the Australian market has undoubtedly been difficult this year but not impossible to crack a return. Our market over the last 12 months has been notorious for its volatility, catching some traders off guard, even seasoned traders have been put to the test. I'm sure those traders that remain focused handled these challenges without too much difficulty.

# Trading systematically with a solid trading plan, and a risk management system in place has its advantages.

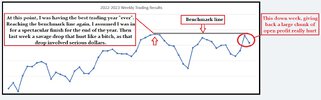

My Weekly and Monthly results for 2022-2023

Up until last week, the end of the year was building nicely for an end-of-year sprint to the finish only to be confronted with more uncertainty. Let's just hope the last 5 days turn out to be kinder than the last week. (5 Losing months and 7 winning months)

The odds haven't been any kinder with 26 losing weeks so far with a string of consecutive losses between the 10th of February 2023 to the 24th of March 2023

View attachment 158627

Trading is a non-linear activity as a result of uncertainties

Greed, fear, and emotions have an impact on trading that induce traders to make irrational decisions. The influence of psychological variables, trading is not a linear activity. To consistently generate profits, traders must be able to adjust to shifting market conditions, manage uncertainty, and restrain their emotions.

Skate.

So these charts are useful...more useful if you had the raw data.

However, a number of questions:

(i) Do the moves higher equate to an average percentage increase in capital or average # winning trades?

(ii) If so, what would have happened had you removed capital at the highs and added capital at the lows?

(iii) Would the equity curve have finished higher over the year?

I'd be very interested in the results.

jog on

duc

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.