- Joined

- 28 December 2013

- Posts

- 6,401

- Reactions

- 24,351

Aussie Stock Forums give us an insight into how other traders thinkI should have kept the Cat. Great results

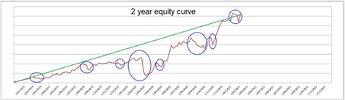

Randomness of tradingHaving observed Mr @Skate profit graphs for some period of time, across a few systems, they all seem to display the characteristic of slowing profit prior to a drawdown of open profits. This warrants further investigation, especially as an exit tigger in-of-itself, of which the above is one way that you could play it.

Finding the next profitable trade mattersComparing to the cat is hard as mr skate has a recipe for getting in good shares that i am nowhere near finding even if he states that all the info is there in the dump it posts

I've always liked the idea of using your system's equity curve as a management tool. If your systems respond quickly to save losing open profits then you've got to accept that it will get out prematurely some times. The entry strategy of the Happy Cat is very similar to many of @Skate's systems. They're all momentum based, ie price has started to move higher. Your systems should be trading many of the same stocks that skate's systems select.

Tuning exits, stalestops, trailing stops etc for the preferred timeframe to optimize medium to long term profit/winners without losing too much open profit seems to be something Skate is particularly skilled at (and we see Peter2 do it all the time in tough times - they both make it look easy, when it obviously ain't!).

There are literally hundreds of ways to trade the markets

There are some much better than others but "trend following" is my all-time favourite. In saying this, you need to find an approach that you can borrow, test & then adapt to suit your own circumstances while having a deep understanding of "Risk, Trading Psychology & Emotional intelligence" as all three directly affect your trading & trading outcome. Once you have a clear understanding you can set about developing a trading strategy that will give you the confidence in trading your own structured trading system.

What I've found

One of the keys to my success is combining different strategies together. When you are able to combine less correlated strategies, it is possible to smooth drawdown, boost win rate & therefore improves your overall risk-adjusted returns. I mention ‘less correlated’ instead of ‘uncorrelated' because it's rare to find profitable strategies that are completely uncorrelated.

Skate.

Mr Ducati @ducati916 went into a bit of explanation about the Market neutral positions onh is Bull market thread.Very very interested but as I understood it:I like the idea of market neutral positions. May be something I will look into later. i'm under the impression that this wouldn't be the easiest in australia though? but i'm naive on the topic.

trade comfortably in different market environments.

I was wondering if anyone knew of an “investor group” that meets with a particular interest in Amibroker. Would love to participate to grow my abilities here. With the advent of Zoom into our lives, online would also be good. Possibly the participants and watchers of this thread may like to create a ‘Skate” group ?

Thanks, I'm in Sydney so Melbourne for a physical meeting doesn't work. However open to online.In Melbourne the ATAA have a SIG that meets once a month. I went a few times years ago so i can't vouch for how they are now.

Newcomers to investing and trading very often don't realise the value that is offered by more experienced people in the profession. For example, beginners won't realise the immense value within the pages of @Skate's ebook for beginning traders available here at ASF.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.