- Joined

- 8 June 2008

- Posts

- 13,700

- Reactions

- 20,415

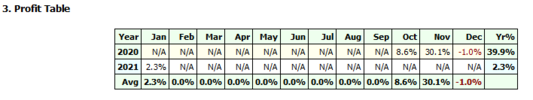

Ok, if so yes so that's very different and just highlight the importance and luck attached to a starting date, even with a good system.QF, I'm guessing if Skate ran a backtest from early Oct 2020 to now, then showed the monthly performance for Oct, Nov, Dec and Jan they would be much closer to the actual performance. The monthly backtest figures shown were from 1st month to end of each month individually, if I'm not mistaken.

Not much to compare in that case