- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

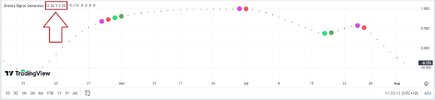

Woolworths Price Chart (WOW)

For this series of posts, I’ll focus on Woolworths (WOW) because it’s a company most people are familiar with, having shopped there without ever considering how each dollar moves through the company. Many don’t even care about these details. However, looking at the chart and the price fluctuations, it’s hard for beginners to understand what drives these daily movements.

To them, Woolworths today looks the same as yesterday. While the reasons behind these movements might not seem important, capturing these movements is crucial. Buying at the right time and selling at the right time is critical to making money - it’s the name of the game.

Skate.

For this series of posts, I’ll focus on Woolworths (WOW) because it’s a company most people are familiar with, having shopped there without ever considering how each dollar moves through the company. Many don’t even care about these details. However, looking at the chart and the price fluctuations, it’s hard for beginners to understand what drives these daily movements.

To them, Woolworths today looks the same as yesterday. While the reasons behind these movements might not seem important, capturing these movements is crucial. Buying at the right time and selling at the right time is critical to making money - it’s the name of the game.

Skate.