- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

10-Position Breakout Strategy (Original Exercise)

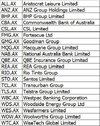

The “10-Position Breakout Strategy” was designed to demonstrate the process of trading (10) large-cap stocks from a watchlist of (20) companies. The primary focus was on the procedure rather than on generating profits.

A Member Suggestion

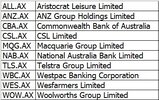

A member proposed trading 10 large-cap stocks from a watchlist of 10 companies, believing it would be easier to manage and understand. This idea seemed unlikely to be a winning strategy, and even if it succeeded, the results were expected to be unimpressive.

Black Box Strategy

This exercise has been labelled a “black box” strategy, and at this point, that statement holds true. Even if you don’t fully understand the logic behind the strategy initially, having a system that tells you what to buy, when to buy, and when to sell is crucial for a beginner. Experience and understanding can come later.

Skate.