You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Dump it Here

- Thread starter Skate

- Start date

- Joined

- 28 August 2022

- Posts

- 7,228

- Reactions

- 11,785

Wel done professor, I am watching and learning all the time.View attachment 174039

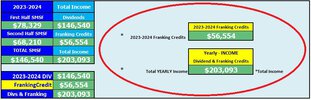

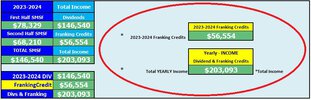

Reflecting on My 2024 Dividend Income and Investment Strategy

I’m taking a moment to reflect on my investment journey and the dividends I’ve received so far. The outcome aligns seamlessly with my investment strategy, reaffirming my approach and decisions.

View attachment 174040

View attachment 174041

View attachment 174042

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

# Disclaimer - This is a theoretical investment exercise

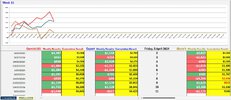

In this exercise, we put "Google (AI) Gemini" head-to-head with seasoned fund manager Dr. Don Hamson from Plato Investment Management. Both were tasked with providing their "top five growth and income stocks" for the next 12 months on the ASX.

First Place - $4,685

# Google Gemini (AI) - RED line on the equity chart

Second Place - $4,423

# Dr. Don Hamson (Expert) - BLUE line on the equity chart

Third Place - $168

# Skate - BROWN line on the equity chart

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

5 ASX 200 shares for trying to build wealth after 50

In the well-written article below If you want to build wealth, then buy and hold investing could be the answer. That's because the longer you are holding shares, the more time you have to benefit from compounding. This is where you generate returns on top of returns, which supercharges your wealth creation.

But which ASX 200 shares?

In the article below it gives 5 shares that will do the job nicely. Firstly, when making a buy-and-hold investment, you will want to look for companies with strong business models and sustainable competitive advantages - they are:

1. CSL Ltd (ASX: CSL)

2. NextDC Ltd (ASX: NXT)

3. REA Group Ltd (ASX: REA)

4. ResMed Inc (ASX: RMD)

5. Xero Ltd (ASX: XRO)

Dividend-paying companies are an important part of my investment portfolio. While the companies mentioned in the article may offer good potential for capital growth, they don't meet my needs of seeking regular dividend income.

Article hyperlink

Skate.

In the well-written article below If you want to build wealth, then buy and hold investing could be the answer. That's because the longer you are holding shares, the more time you have to benefit from compounding. This is where you generate returns on top of returns, which supercharges your wealth creation.

But which ASX 200 shares?

In the article below it gives 5 shares that will do the job nicely. Firstly, when making a buy-and-hold investment, you will want to look for companies with strong business models and sustainable competitive advantages - they are:

1. CSL Ltd (ASX: CSL)

2. NextDC Ltd (ASX: NXT)

3. REA Group Ltd (ASX: REA)

4. ResMed Inc (ASX: RMD)

5. Xero Ltd (ASX: XRO)

Dividend-paying companies are an important part of my investment portfolio. While the companies mentioned in the article may offer good potential for capital growth, they don't meet my needs of seeking regular dividend income.

Article hyperlink

MSN

www.msn.com

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Curiosity often leads to discovery - How did the 5 perform?

I was curious. What if I had invested $100,000 in each of these companies (CSL, NXT, REA, RMD and XRO) 12 months ago? How would my portfolio look today? - Well, the results aren't too shabby at all.

Fast forward to the present

The hypothetically invested amount totals $500,000, distributing $100,000 equally among the five companies.

1. Capital Gains: Over the course of the year, these investments would have yielded a capital gain of $97,686.

2. Dividends: In addition to the capital gains, I would have also received dividends amounting to $3,136.

3. Franking Credits: The cherry on top was the $260 worth of franking credits.

In summary

The total return from these investments was not just satisfactory, but quite impressive. It’s a testament to the potential rewards of thoughtful investing. This exercise reaffirms the importance of patience, research, and strategic planning in investing. Remember, every investment journey begins with curiosity!

Skate.

I was curious. What if I had invested $100,000 in each of these companies (CSL, NXT, REA, RMD and XRO) 12 months ago? How would my portfolio look today? - Well, the results aren't too shabby at all.

Fast forward to the present

The hypothetically invested amount totals $500,000, distributing $100,000 equally among the five companies.

1. Capital Gains: Over the course of the year, these investments would have yielded a capital gain of $97,686.

2. Dividends: In addition to the capital gains, I would have also received dividends amounting to $3,136.

3. Franking Credits: The cherry on top was the $260 worth of franking credits.

In summary

The total return from these investments was not just satisfactory, but quite impressive. It’s a testament to the potential rewards of thoughtful investing. This exercise reaffirms the importance of patience, research, and strategic planning in investing. Remember, every investment journey begins with curiosity!

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

A Comparative Analysis: Dividend-Paying Companies vs. Growth Companies

Driven by curiosity, I embarked on a hypothetical investment journey. I wondered, what if I had invested the same amount in the dividend-paying companies I selected, hoping for dividends, franking credits, and some capital gains along the way?

My selection included (ANZ, BHP, CBA, FMG, and WDS)

While these companies didn’t quite match the capital gains of the companies listed in the article (CSL, NXT, REA, RMD, and XRO), they served my portfolio objective of collecting dividends and franking credits admirably.

Here’s a breakdown of the performance of my investment strategy

1. Capital Gains: "Over the course of the year", my investments would have yielded a capital gain of $47,700. (This is a respectable)

2. Dividends: In addition to the capital gains, I would have also received dividends amounting to $33,328. (This is a significant income stream)

3. Franking Credits: The icing on the cake was the $13,466 worth of franking credits. (This is a nice tax advantage for a retiree)

So, how do these two strategies compare?

The overall result from the article’s picks was $101,082. My investment strategy, while falling a bit short with a total of $94,494, fulfilled its objective. It provided a steady income stream (dividends) and tax advantages (franking credits), even if the capital gains were not as high.

In conclusion

While my investment strategy is the right one for me - the “best” investment strategy for others depends on your financial goals. If you’re seeking capital growth, investing in growth companies might be the way to go. But if you’re looking for regular income and tax advantages, dividend-paying companies could be a better fit.

Skate.

Driven by curiosity, I embarked on a hypothetical investment journey. I wondered, what if I had invested the same amount in the dividend-paying companies I selected, hoping for dividends, franking credits, and some capital gains along the way?

My selection included (ANZ, BHP, CBA, FMG, and WDS)

While these companies didn’t quite match the capital gains of the companies listed in the article (CSL, NXT, REA, RMD, and XRO), they served my portfolio objective of collecting dividends and franking credits admirably.

Here’s a breakdown of the performance of my investment strategy

1. Capital Gains: "Over the course of the year", my investments would have yielded a capital gain of $47,700. (This is a respectable)

2. Dividends: In addition to the capital gains, I would have also received dividends amounting to $33,328. (This is a significant income stream)

3. Franking Credits: The icing on the cake was the $13,466 worth of franking credits. (This is a nice tax advantage for a retiree)

So, how do these two strategies compare?

The overall result from the article’s picks was $101,082. My investment strategy, while falling a bit short with a total of $94,494, fulfilled its objective. It provided a steady income stream (dividends) and tax advantages (franking credits), even if the capital gains were not as high.

In conclusion

While my investment strategy is the right one for me - the “best” investment strategy for others depends on your financial goals. If you’re seeking capital growth, investing in growth companies might be the way to go. But if you’re looking for regular income and tax advantages, dividend-paying companies could be a better fit.

Skate.

- Joined

- 20 July 2021

- Posts

- 11,946

- Reactions

- 16,627

since i down-play capital gains , i would conclude the opposite , i see a small pie with a giant cherry ( bubble ?? ) on topIn summary

The total return from these investments was not just satisfactory, but quite impressive. It’s a testament to the potential rewards of thoughtful investing. This exercise reaffirms the importance of patience, research, and strategic planning in investing. Remember, every investment journey begins with curiosity!

but that is just my point of view

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Elevating the investment analysis

Let’s examine the real-world values of my investment portfolio. What would be the real dollar performance of my chosen five companies? It’s crucial to remember that past performance doesn’t guarantee future results, and the performance this year may vary from the last, that's a given.

# Hypothetically the results aren't too shabby

Skate.

Let’s examine the real-world values of my investment portfolio. What would be the real dollar performance of my chosen five companies? It’s crucial to remember that past performance doesn’t guarantee future results, and the performance this year may vary from the last, that's a given.

# Hypothetically the results aren't too shabby

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

since i down-play capital gains , i would conclude the opposite , i see a small pie with a giant cherry ( bubble ?? ) on top

but that is just my point of view

@divs4ever, I appreciate your perspective. You’ve highlighted an important aspect - the balance between capital gains and dividends. While you see a small pie with a potentially inflated cherry on top, it’s a reflection of your investment philosophy which downplays capital gains.

However, as I’ve mentioned before, "investment strategies" are highly personal and depend on individual financial goals. While my strategy suits my objectives, it might not align with others. The “best” strategy is often the one that aligns with one’s financial goals and risk tolerance

Skate

- Joined

- 20 July 2021

- Posts

- 11,946

- Reactions

- 16,627

also capital gains need to be crystallized to be become anything more than an ego/confidence-booster

take

as an example PME , the share price is flying high .. while recent dividend returns are not , can you live on promises alone ??

i think not

i hold PME , and while i am getting a 200% return ( per year ) on investment , that does not apply to those than bought at $50 and above

now sure the earnings and divs can grow in the coming years , but for a $100 share how much premium do you pay for 'growth '

take

as an example PME , the share price is flying high .. while recent dividend returns are not , can you live on promises alone ??

i think not

| PME | PRO MEDICUS LIMITED ORDINARY |

| Balance Date | Dividend Type | Cents per share | Ccy | Franked % | Ex-Dividend Date | Books Close Date | Pay Date |

|---|---|---|---|---|---|---|---|

| 31/12/2023 | Interim | 18.000 | AUD | 100.00 | 29/02/2024 | 01/03/2024 | 22/03/2024 |

| 30/06/2023 | Final | 17.000 | AUD | 100.00 | 06/09/2023 | 07/09/2023 | 28/09/2023 |

| 31/12/2022 | Interim | 13.000 | AUD | 100.00 | 02/03/2023 | 03/03/2023 | 24/03/2023 |

| 30/06/2022 | Final | 12.000 | AUD | 100.00 | 08/09/2022 | 09/09/2022 | 30/09/2022 |

| 31/12/2021 | Interim | 10.000 | AUD | 100.00 | 03/03/2022 | 04/03/2022 | 25/03/2022 |

| 30/06/2021 | Final | 8.000 | AUD | 100.00 | 09/09/2021 | 10/09/2021 | 01/10/2021 |

| 31/12/2020 | Interim | 7.000 | AUD | 100.00 | 04/03/2021 | 05/03/2021 | 19/03/2021 |

| 30/06/2020 | Final | 6.000 | AUD | 100.00 | 10/09/2020 | 11/09/2020 | 02/10/2020 |

| 31/12/2019 | Interim | 6.000 | AUD | 100.00 | 05/03/2020 | 06/03/2020 | 20/03/2020 |

| 30/06/2019 | Final | 4.500 | AUD | 100.00 | 12/09/2019 | 13/09/2019 | 04/10/2019 |

| Earnings and Dividends | ||||

| Forecast (cents per share) | ||||

| 2023 | 2024 | 2025 | 2026 | |

| EPS | 58.0 | 75.7 | 99.5 | 123.3 |

| PE(x) | 181.0 | 138.7 | 105.5 | -- |

| DPS | 30.0 | 38.0 | 49.5 | 64.6 |

i hold PME , and while i am getting a 200% return ( per year ) on investment , that does not apply to those than bought at $50 and above

now sure the earnings and divs can grow in the coming years , but for a $100 share how much premium do you pay for 'growth '

- Joined

- 20 July 2021

- Posts

- 11,946

- Reactions

- 16,627

has ANZ paid yet , you might be underestimating that result even though ANZ will only pay once during your 12 month experiment ( if i am not mistaken )Elevating the investment analysis

Let’s examine the real-world values of my investment portfolio. What would be the real dollar performance of my chosen five companies? It’s crucial to remember that past performance doesn’t guarantee future results, and the performance this year may vary from the last, that's a given.

# Hypothetically the results aren't too shabby

View attachment 174213

Skate.

but the franking credits will be very helpful , for some

- Joined

- 20 July 2021

- Posts

- 11,946

- Reactions

- 16,627

@divs4ever, I appreciate your perspective. You’ve highlighted an important aspect - the balance between capital gains and dividends. While you see a small pie with a potentially inflated cherry on top, it’s a reflection of your investment philosophy which downplays capital gains.

However, as I’ve mentioned before, "investment strategies" are highly personal and depend on individual financial goals. While my strategy suits my objectives, it might not align with others. The “best” strategy is often the one that aligns with one’s financial goals and risk tolerance

Skate

i note that capital gains are the dominant desire in the US as a result in different tax structure , so please take your own local tax structures into consideration

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

has ANZ paid yet , you might be underestimating that result even though ANZ will only pay once during your 12 month experiment ( if i am not mistaken )

but the franking credits will be very helpful , for some

@ANZ pays their dividends twice a year. Up until the last dividend franking was at 100%. They have reduced their franking in line where the profits are generated. (which makes sense). ANZ current franking percentage is 56%

1. ANZ Bank (ASX: ANZ) - Dividend Yield: 6.6%, Franking Credits: 56%

2. BHP (ASX: BHP) - Dividend Yield: 4.7%, Franking Credits: 100%

3. CBA Bank (ASX: CBA) - Dividend Yield: 3.9%, Franking Credits: 100%

4. FMG (ASX: FMG) - Dividend Yield: 7.6%, Franking Credits: 100%

5. Woodside Energy (ASX: WDS) - Dividend Yield: 11.7%, Franking Credits: 100%

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

@divs4ever, I'm in a reflective mood and want to share my thoughts on the 'Equation for Success.' I know readers may be thin, but the act of posting is liberating. I hope my musings resonate with someone, even if they're quickly dismissed by others.

The equation for success is simple, Effort = Rewards

This principle applies to any goal we aspire to achieve, whether it's trading and investing or personal growth and development. The more effort we put in, the greater the reward we can expect.

Skate.

The equation for success is simple, Effort = Rewards

This principle applies to any goal we aspire to achieve, whether it's trading and investing or personal growth and development. The more effort we put in, the greater the reward we can expect.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Effort Equals Rewards

In life, we often find ourselves yearning for rewards. Be it in the form of accolades, recognition, wealth, or personal satisfaction, these rewards serve as the end goal that motivates us. However, it’s crucial to remember that rewards are not simply handed out, they are earned.

Skate.

In life, we often find ourselves yearning for rewards. Be it in the form of accolades, recognition, wealth, or personal satisfaction, these rewards serve as the end goal that motivates us. However, it’s crucial to remember that rewards are not simply handed out, they are earned.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

The Equation of Success

This is where the equation of success comes into play - Effort Equals Rewards.

Skate.

This is where the equation of success comes into play - Effort Equals Rewards.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

The Value of Effort

Effort is the price we pay to attain rewards. It’s the time, energy, and resources we invest towards a goal. It’s the late nights spent studying, the years spent building a strategy from scratch, or the countless hours spent mastering a skill whether it be trading or investing.

Without effort, our goals remain mere dreams

Effort transforms these dreams into achievable targets. It’s the bridge that connects where we are now to where we want to be.

Skate.

Effort is the price we pay to attain rewards. It’s the time, energy, and resources we invest towards a goal. It’s the late nights spent studying, the years spent building a strategy from scratch, or the countless hours spent mastering a skill whether it be trading or investing.

Without effort, our goals remain mere dreams

Effort transforms these dreams into achievable targets. It’s the bridge that connects where we are now to where we want to be.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

The Allure of Rewards

Rewards are the fruits of our labour. They validate our efforts and provide a sense of accomplishment. However, the allure of rewards can sometimes lead us to overlook the effort required. We see the successful trader or the accomplished investor, and we desire their success without fully understanding the effort it took to get there.

Skate.

Rewards are the fruits of our labour. They validate our efforts and provide a sense of accomplishment. However, the allure of rewards can sometimes lead us to overlook the effort required. We see the successful trader or the accomplished investor, and we desire their success without fully understanding the effort it took to get there.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

The Inconvenient Truth

The truth is, there’s "no shortcut" to success. The path to any worthwhile reward is paved with effort. It’s easy to desire the reward, but it’s the willingness to put in the effort that separates dreamers from achievers.

We live in a world that often promotes instant gratification

However, true success is rarely instant. It’s the result of consistent effort over time. You often hear the phrase "an overnight success" but fail to realise that success was a lifetime in the making.

Skate.

The truth is, there’s "no shortcut" to success. The path to any worthwhile reward is paved with effort. It’s easy to desire the reward, but it’s the willingness to put in the effort that separates dreamers from achievers.

We live in a world that often promotes instant gratification

However, true success is rarely instant. It’s the result of consistent effort over time. You often hear the phrase "an overnight success" but fail to realise that success was a lifetime in the making.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Before I step off my soapbox

The next time you find yourself desiring a reward, ask yourself “Am I willing to put in the effort?” Remember, effort equals rewards. Embrace the effort, enjoy the process, and the rewards will follow.

Remember, the journey towards any reward is often filled with persistence, hard work and determination or as I call it a PhD. Embrace the process and the rewards will surely follow.

Skate.

The next time you find yourself desiring a reward, ask yourself “Am I willing to put in the effort?” Remember, effort equals rewards. Embrace the effort, enjoy the process, and the rewards will follow.

Remember, the journey towards any reward is often filled with persistence, hard work and determination or as I call it a PhD. Embrace the process and the rewards will surely follow.

Skate.

Similar threads

- Poll

- Replies

- 258

- Views

- 21K