- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Sorry Good Old Friend Skates as you are probably aware we on the Good Ship own many millions WC8 and I am really conversed with this MAGNIFICENT BEAUTY. As you also know I am a firm believer in TRUE DATA but Lies, Damned Lies and Statistics is not for me and my young crew

In your post of Percentage Filter Today at 3.22 pm ASF Broken Time. First of all there were No Sales of WC8 at 0.43.5 cents on Friday 9/Feb/2024

@Captain_Chaza, you may have missed my original post - it's below as it "clarifies the situation".

I'm now wondering

I'm now curious about how my trading strategy would have performed since the beginning of the year.

Amibroker reports

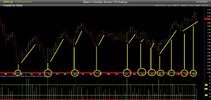

Uniquely Amibroker uses the "end of the week" in their reports instead of the actual trade date, Amibroker does this as a way of saying "the week ending" and shouldn't be confused when knowing this fact. The trade signal date in the first chart displays the actual date WC8 was actioned. (Buy and Sell)

The price chart for WC8

In this backtest, confirmed by the price chart the buy was on the opening price on "Monday the 5th of February 2024" and the position was exited on the "4th of March 2024" or as Amibroker would report "the week ending" 8th of March 2024. The sale of WC8 was from a "Take Profit Stop".

I hope this helps understand the confusion my previous post presented.

Skate.