- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

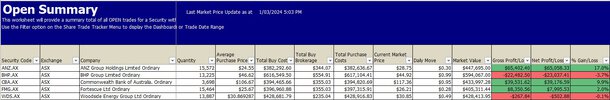

Ever wondered if artificial intelligence (AI) can outperform human experts in stock picking?

In this fascinating exercise, we put "Google (AI) Gemini" head-to-head with seasoned fund manager Dr. Don Hamson from Plato Investment Management. Both were tasked with providing their "top five growth and income stocks" for the next 12 months on the ASX. As we reach the end of the fourth week of this "AI vs Humans" experiment, let's take a quick update on the progress to determine the superior stock picker.

First Place - $4,589

# Google Gemini (AI) - RED line on the equity chart

Second Place - $4,170

# Dr. Don Hamson (Expert) - BLUE line on the equity chart

Third Place - $2,556

# Skate - BROWN line on the equity chart

Skate.