- Joined

- 8 March 2007

- Posts

- 2,971

- Reactions

- 4,127

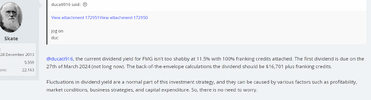

In summary@ducati916, while I accept the observation and remarks about dividends in the article, I concede that while share prices can indeed be volatile, dividends often exhibit a remarkable consistency. Let me make a few remarks of my own.

Stable Dividend

Large ASX companies that I have invested in, tend to have Stable Dividend. These five companies (ANZ, BHP, CBA, FMG and WDS) have a dividend policy to ensure their shareholder base (investors for dividends) receives a steady dividend stream every 6 months, regardless of market volatility. That's the first point I want to make for you to consider.

This is important

I do concede that the exact dollar amount of dividends paid every 6 months will vary depending on the company’s earnings and overall performance during the preceding fiscal period.

Why Stable Dividends Matter

Stable dividend policies attract investors and enhance a company’s standing in financial markets. Such companies have the potential to raise dividends over the long term and at times enhance their share price.

Comparing Apples with Oranges

When comparing American companies to large Australian companies it’s essential to recognise differences. Australian companies not only pay regular dividends but also offer franking credits, making dividends even more attractive.

From one of the hyperlinks, you posted

"Large, stable corporations almost 'never cut dividends' as a strategic choice".

Do big companies cut dividends to grow?

We look at why successful companies almost never cut dividends, instead reducing them only in the face of low earnings or challenging economic conditions.www.mckinsey.com

In summary

While dividend cuts can occur, especially during exceptional circumstances, established companies tend to 'prioritise dividend stability'. So, when it comes to dividends, the beat goes on! (Sonny & Cher)

Skate.

"While dividend cuts can occur, especially during exceptional circumstances, established companies tend to 'prioritise dividend stability'. So, when it comes to dividends, the beat goes on! (Sonny & Cher)"

Skate.

And that is why Dividends are always calculated on "The UNDER"

Have you seen what happens to a share price when their Dividends are reduced

I am not joking but it is often like a "Black Swan Events"

tbc