- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

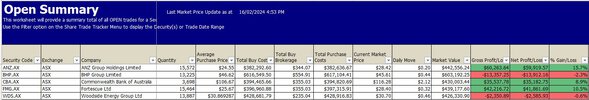

Can Google's Gemini (AI) beat a human at trading

As (AI) continues to advance, it is likely to become an indispensable tool for small investors, providing us with a level playing field and helping us to stay ahead of the curve in the ever-changing financial landscape. What's particularly fascinating is that (AI) not only models the traditional "Technical Analysis" aspects but also has a solid grasp on sentiment analysis. This allows (AI) to interpret the financial market and identify the underlying reasons behind price fluctuations.

Skate.