- Joined

- 8 March 2007

- Posts

- 3,066

- Reactions

- 4,302

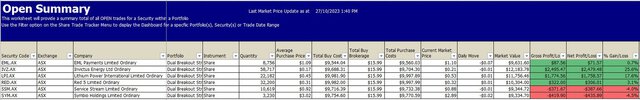

I am not into POO jokes at my ageView attachment 164522

It's a bit weird

The phrase "If you don't poo when you first go to the toilet, you always get a second go" may not be a well-known proverb because I just made it up, but it's a weird way to express the idea of persistence and second chances. In a broader sense, it implies that if we don't succeed at something on our first attempt, there's always an opportunity to try again.

So, the next time you encounter a setback or failure, remember that it's a normal part of life and the learning process. Don't give up – keep pushing forward, and know that success may be just around the corner.

Skate.