- Joined

- 8 March 2007

- Posts

- 3,041

- Reactions

- 4,233

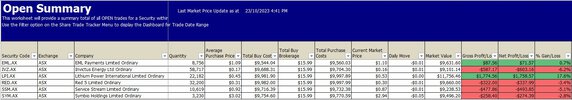

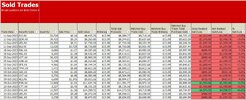

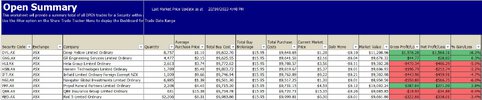

If I can do it ( SOMETIMES)Thanks @Skate for your posts on the AI analyses.

Is it just me or do those "analyses" read like a description of the system code. There's no real analysis for me there.

If I asked the AI to analyze a cat, I'd expect the result to conclude that the cat's four legs make it more stable than if it had less.

Is it possible to ask the AI for ideas to improve the systems? eg in high volatile conditions, in unsuitable market conditions (ie down trend)?

Any robot/A.I. may be able do it (All Times )

Keep the good work up Captain Skates

Seems like I am your Biggest Fan

PS I cat may even come up looking like "a Bitch"

Who knows? lol!

Salute and Gods' Speed