- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

In today's series of posts

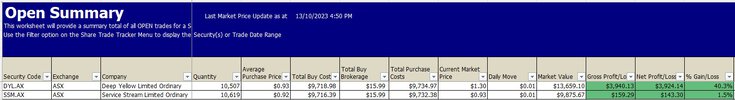

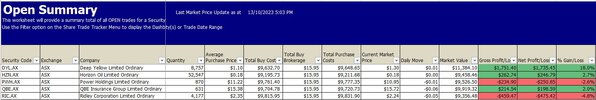

I wanted to provide an educational example for those who are new to trading. The recent experiences of traders like Nick Radge have highlighted the inherent risks of relying solely on historical strategy performance. It serves as a valuable lesson that even the most reliable strategies can fail, and markets can quickly turn against us.

Nick Radge, an experienced and skilled professional, has faced significant drawdowns over the past 18 months. This demonstrates that no one is immune to changing market conditions. It is crucial to understand that past success does not guarantee future profits. Traders must constantly adapt and take steps to mitigate risks, especially during challenging periods.

The main takeaway from this discussion is that trading is not a guaranteed path to success. It requires continuous learning, adaptability, and a disciplined approach to risk management. New traders should be cautious about blindly following strategies based solely on historical performance and instead focus on building their own understanding and skills.

It is essential to study various trading methodologies, develop a robust risk management plan, and regularly reassess and adapt strategies based on changing market conditions. By doing so, traders can increase their chances of long-term success and navigate the ups and downs of the financial markets more effectively.

Remember, trading is a journey that involves both successes and setbacks. It is through continuous learning and experience that traders can refine their skills, manage risks, and ultimately achieve their financial goals.

Skate.

I wanted to provide an educational example for those who are new to trading. The recent experiences of traders like Nick Radge have highlighted the inherent risks of relying solely on historical strategy performance. It serves as a valuable lesson that even the most reliable strategies can fail, and markets can quickly turn against us.

Nick Radge, an experienced and skilled professional, has faced significant drawdowns over the past 18 months. This demonstrates that no one is immune to changing market conditions. It is crucial to understand that past success does not guarantee future profits. Traders must constantly adapt and take steps to mitigate risks, especially during challenging periods.

The main takeaway from this discussion is that trading is not a guaranteed path to success. It requires continuous learning, adaptability, and a disciplined approach to risk management. New traders should be cautious about blindly following strategies based solely on historical performance and instead focus on building their own understanding and skills.

It is essential to study various trading methodologies, develop a robust risk management plan, and regularly reassess and adapt strategies based on changing market conditions. By doing so, traders can increase their chances of long-term success and navigate the ups and downs of the financial markets more effectively.

Remember, trading is a journey that involves both successes and setbacks. It is through continuous learning and experience that traders can refine their skills, manage risks, and ultimately achieve their financial goals.

Skate.