- Joined

- 28 December 2013

- Posts

- 6,401

- Reactions

- 24,350

The weekly summary

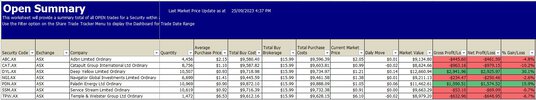

Despite the challenging market conditions, I remain confident in the Pressure Strategy's potential for long-term success. The strategy's first week of trading did not go as planned, with the ASX XAO index starting the week at 7482.6 and closing at 7270, a decline of over 3%. This unfavorable trading environment undoubtedly had an impact on the strategy's performance.

However, it's important to remember that the Pressure Strategy is designed to perform well in a variety of market conditions, including periods of volatility and uncertainty. While the Pressure Strategy's first week of trading was not as successful as I had hoped, I remain confident in its potential for long-term success and I will continue to monitor its performance closely and make any necessary adjustments.

Skate.