- Joined

- 28 December 2013

- Posts

- 6,401

- Reactions

- 24,350

We read that stop losses reduce system performance. This is especially so when the market trades in a sideways range for a long time. Trend traders are suffering "death by a thousand cuts" as we try to hang on. Trend trading isn't dead. It's just in a coma and will awake one day.

Frustration leads to considering changes to our trading style and we're tempted to trade shorter timeframes (daily, hourly). Think very carefully about doing this. Trend trading is much easier than swing trading. If we're not completely disciplined with our swing trade entries and exits then we'll lose our capital much faster than we like. I'd suggest swing trade the weekly charts and avoid the daily fluctuations. It's still a tough gig as our market remains in this large range.

Wall Street closes lower, giving S&P 500 another losing week

Wall Street capped a choppy week of trading with a broad slide for stocks Friday, giving the S&P 500 its second losing week in a row.

Correlation

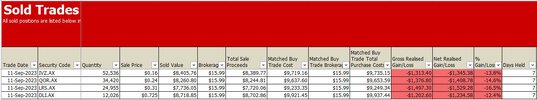

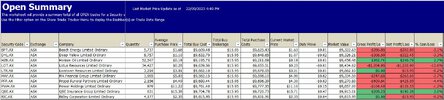

I regularly 'backtest' my system to see what is happening.

Nope, I’m sure the majority of hobby traders wouldn’t. Personally, as a systematic trend trader I just buy signals.Do you think anybody reads 452 page reports over the Week-end?

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.