- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

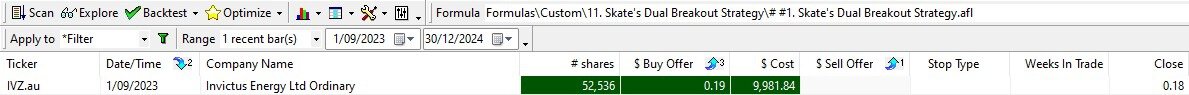

At the Platinum level, this is not required as your backtesting code accesses a "Current & Past" watchlist where the security will remain, and you'd use the NorgateIndexConstituentTimeSeries function in your trading rules.

@Richard Dale, I appreciate your prompt response and the workaround you have proposed. However, it is evident that in order to address this issue effectively, the most straightforward solution is for developers or traders to upgrade to the "Platinum Subscription level." The lower-level subscription models indeed have limited value and may not provide the necessary features and functionalities required for comprehensive backtesting and trading.

By opting for the Platinum Subscription level, users gain access to a "Current & Past" watchlist, ensuring that open positions can be tracked even if a security is no longer in the regular watchlist. Additionally, the availability of the NorgateIndexConstituentTimeSeries function further enhances the trading rules and capabilities within the backtesting code.

Therefore, for those serious about developing effective trading strategies and maximising the potential of AmiBroker, I strongly recommend considering the "Platinum Subscription level" as it offers the most comprehensive features and eliminates the limitations associated with lower subscription tiers.

Thank you once again for your insight and assistance in addressing this matter.

Skate.