Richard Dale

Norgate Data

- Joined

- 22 February 2005

- Posts

- 277

- Reactions

- 207

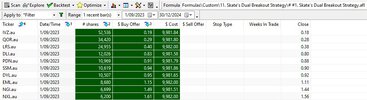

@qldfrog, I hope others duplicate the "Dual Breakout Strategy" for further evaluation. I'm impressed with the initial result (and I'm not easily impressed) and with a few moving parts the strategy should be easy to replicate for those interested,

Perhaps you could (re-) disclose the rules (and/or Amibroker, RealTest, Wealth-Lab, Zipline or other backtesting platform code) so others can try this out - you might have done so already but it's hard to determine where in 459 pages of a thread at this late hour!