- Joined

- 25 July 2021

- Posts

- 875

- Reactions

- 2,215

@Skate the name of the thread is 'Dump it Hear' so I going to dump something, it's not a pile of trash for kerb side cleanup, I'm sure that people can sort through and find something they can make use of.

Understanding Risk-Adjusted Returns

July 13, 2023 | Tim Fortier

Investments always have an inherent trade-off between potential rewards and risks.

As an investor, it’s crucial to assess the risk-reward profile of your investments to make informed decisions.

One effective tool that helps you achieve this balance is risk-adjusted returns. Today we’ll delve into the concept, its significance, and measurement methods.

First, let’s answer how risk-adjusted returns can assist you in maximizing your investment gains while effectively managing risks.

Defining Risk-Adjusted Returns

Risk-adjusted investment returns are a way of measuring the performance of an investment by considering the amount of risk taken.

This is important because it allows investors to compare the performance of different investments equally, regardless of the amount of risk involved.

There are several different methods for calculating risk-adjusted investment returns. One common method is to use the Sharpe ratio.

The Sharpe ratio is calculated by dividing the investment’s return by its standard deviation. The standard deviation measures the volatility of the investment’s returns.

A higher Sharpe ratio indicates that the investment has generated a higher return for a given level of risk.

In the above example, even though both investments indicate a similar return of 11%, investment A has half the volatility and, thus twice the Sharpe ratio.

If you think of the two as car rides, investment A takes the highway, drives 5 mph under the speed limit, and arrives at the destination right on time.

Investment B may speed, take corners too fast, and may have to brake quickly to avoid traffic.

It’s probably not the car you want to be riding in, as the chance of an accident or ticket is much greater.

There is also something in investing known as volatility drag that can slow down the growth rate. The greater the volatility, the greater the need to make up for periods of negative volatility, which can slow the compounding of money.

The more consistent (or boring) an investment is, the more likely it will reach the financial goal that you have set.

Another common method for calculating risk-adjusted investment returns is the Sortino ratio. The Sortino ratio is like the Sharpe ratio, but it uses a different measure of risk, the downside deviation.

The downside deviation measures the volatility of the investment’s negative returns. A higher Sortino ratio indicates that the investment has generated a higher return for a level of downside risk.

Perhaps the easiest measure of risk to understand is what is known as maximum drawdown.

A drawdown in trading is the percentage you are down from the latest equity peak. It’s a peak-to-trough decline over a certain period. You are in a drawdown if your equity is not at an all-time high. Thus, most of the time, you’ll be in a drawdown.

The reason this is so important to understand is that it influences your behavior and your returns. Both are dependent on each other.

What is a good or acceptable drawdown percentage? There is no definite answer, but preferable to be as low as possible. If it gets too big, more than 20%, many investors lose hope and stop investing.

Thus, 20% can serve as a heuristic for max drawdown. Most investors believe they can handle bigger drawdowns, but we believe they overestimate their pain tolerance.

Why Understanding Risk Is Important

If you have an investment or trading strategy liable to swings in return, it might lead to two things:

When considering investment choices, while investment returns are important, the best way to view returns is when measured on a risk-adjusted basis.

All things being equal, an investor should strive to select investments that offer high Sharpe and Sortino ratios defined as 1.0 or greater, and maximum drawdowns that are not much greater than the compound annual growth.

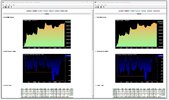

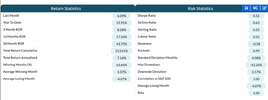

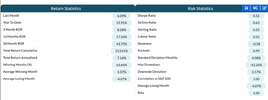

For example, the following tables illustrate the return and risk characteristics of the S&P 500 SPDR (SPY).

For the investment period January 2007–June 2023, the CAGR (Total Return Annualized) is 7.16%. But in the next column, you can see that the maximum drawdown is -52.20%.

This is an example of an investment with negative asymmetry, meaning the downside risk is much greater than the expected annualized return.

You can also see that the Sharpe ratio is 0.52, and the Sortino ratio is 0.63.

Let’s compare this to a systematic program designed to achieve high-risk-adjusted returns.

Here we can see that the Total Return Annualized is 10.59%, but yet the Maximum Drawdown is only -7.68%! This is an excellent example of where the investment returns have positive asymmetry, meaning more return with less risk.

Notice too that both the Sharpe ratio and the Sortino ratio are well over 1.00.

Investments with these types of risk measurements will produce more predictable outcomes than the randomness of the market.

Here are some additional tips for using risk-adjusted investment returns:

Understanding Risk-Adjusted Returns

July 13, 2023 | Tim Fortier

Investments always have an inherent trade-off between potential rewards and risks.

As an investor, it’s crucial to assess the risk-reward profile of your investments to make informed decisions.

One effective tool that helps you achieve this balance is risk-adjusted returns. Today we’ll delve into the concept, its significance, and measurement methods.

First, let’s answer how risk-adjusted returns can assist you in maximizing your investment gains while effectively managing risks.

Defining Risk-Adjusted Returns

Risk-adjusted investment returns are a way of measuring the performance of an investment by considering the amount of risk taken.

This is important because it allows investors to compare the performance of different investments equally, regardless of the amount of risk involved.

There are several different methods for calculating risk-adjusted investment returns. One common method is to use the Sharpe ratio.

The Sharpe ratio is calculated by dividing the investment’s return by its standard deviation. The standard deviation measures the volatility of the investment’s returns.

A higher Sharpe ratio indicates that the investment has generated a higher return for a given level of risk.

In the above example, even though both investments indicate a similar return of 11%, investment A has half the volatility and, thus twice the Sharpe ratio.

If you think of the two as car rides, investment A takes the highway, drives 5 mph under the speed limit, and arrives at the destination right on time.

Investment B may speed, take corners too fast, and may have to brake quickly to avoid traffic.

It’s probably not the car you want to be riding in, as the chance of an accident or ticket is much greater.

There is also something in investing known as volatility drag that can slow down the growth rate. The greater the volatility, the greater the need to make up for periods of negative volatility, which can slow the compounding of money.

The more consistent (or boring) an investment is, the more likely it will reach the financial goal that you have set.

Another common method for calculating risk-adjusted investment returns is the Sortino ratio. The Sortino ratio is like the Sharpe ratio, but it uses a different measure of risk, the downside deviation.

The downside deviation measures the volatility of the investment’s negative returns. A higher Sortino ratio indicates that the investment has generated a higher return for a level of downside risk.

Perhaps the easiest measure of risk to understand is what is known as maximum drawdown.

A drawdown in trading is the percentage you are down from the latest equity peak. It’s a peak-to-trough decline over a certain period. You are in a drawdown if your equity is not at an all-time high. Thus, most of the time, you’ll be in a drawdown.

The reason this is so important to understand is that it influences your behavior and your returns. Both are dependent on each other.

What is a good or acceptable drawdown percentage? There is no definite answer, but preferable to be as low as possible. If it gets too big, more than 20%, many investors lose hope and stop investing.

Thus, 20% can serve as a heuristic for max drawdown. Most investors believe they can handle bigger drawdowns, but we believe they overestimate their pain tolerance.

Why Understanding Risk Is Important

If you have an investment or trading strategy liable to swings in return, it might lead to two things:

- You might increase the risk of ruin, especially if you are leveraged.

- Swings in volatility normally lead to behavioral mistakes.

When considering investment choices, while investment returns are important, the best way to view returns is when measured on a risk-adjusted basis.

All things being equal, an investor should strive to select investments that offer high Sharpe and Sortino ratios defined as 1.0 or greater, and maximum drawdowns that are not much greater than the compound annual growth.

For example, the following tables illustrate the return and risk characteristics of the S&P 500 SPDR (SPY).

For the investment period January 2007–June 2023, the CAGR (Total Return Annualized) is 7.16%. But in the next column, you can see that the maximum drawdown is -52.20%.

This is an example of an investment with negative asymmetry, meaning the downside risk is much greater than the expected annualized return.

You can also see that the Sharpe ratio is 0.52, and the Sortino ratio is 0.63.

Let’s compare this to a systematic program designed to achieve high-risk-adjusted returns.

Here we can see that the Total Return Annualized is 10.59%, but yet the Maximum Drawdown is only -7.68%! This is an excellent example of where the investment returns have positive asymmetry, meaning more return with less risk.

Notice too that both the Sharpe ratio and the Sortino ratio are well over 1.00.

Investments with these types of risk measurements will produce more predictable outcomes than the randomness of the market.

Here are some additional tips for using risk-adjusted investment returns:

- Use risk-adjusted investment returns to compare the performance of different investments.

- Consider the time horizon of your investment when using risk-adjusted investment returns.

- Diversify your portfolio among non-correlated assets to reduce risk.

- Monitor your investments regularly.

- Consult with a financial advisor to get personalized advice.