- Joined

- 20 November 2005

- Posts

- 787

- Reactions

- 92

You don't necessarily need different systems, markets or instruments to lower drawdowns, although I do agree that different system styles can certainly make it easier.

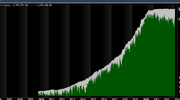

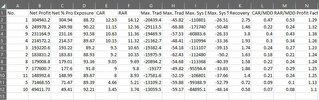

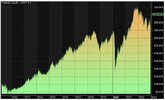

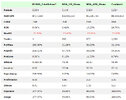

Here are two monthly momentum strategies, one traded on the ASX and one traded in the US.

50/50 allocation.

Long only equities.

On the surface, combined, they perform extremely favourably compared to the benchmark.

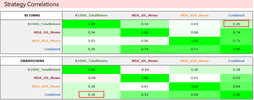

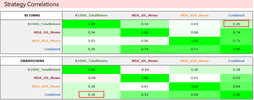

Looking under the hood, the correlations, both returns and drawdowns, are also extremely favourable.

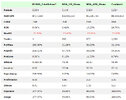

Here are two monthly momentum strategies, one traded on the ASX and one traded in the US.

50/50 allocation.

Long only equities.

On the surface, combined, they perform extremely favourably compared to the benchmark.

Looking under the hood, the correlations, both returns and drawdowns, are also extremely favourable.