- Joined

- 8 June 2008

- Posts

- 14,055

- Reactions

- 21,156

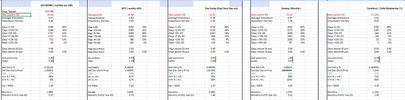

FWIW I have 3 weekly strategiesSkate's probably off on hols for a whilte ArtMaster. Everyone needs some downtime

Good to see some green shoots in the market. Tricky times, but yes, most market filters probably indicating buy signals from recent activity (weekly timeframe).

Nick Radge has been known to pop in from time to time here - I'm not sure that they actively trade/follow those strategies any more, but would be interesting to hear from anyone that does actively trade variations on the Unholy Grail themes.

1 relatively aggressive and which started buying a few weeks back, the other 2 more conservative with their index filter

Only one of these 2 had 1 buy on a parcel this morning....we are not in a clear long trend yet for weekly